Are Online Gambling Winnings Taxable In Canada

- Are Online Gambling Winnings Taxable In Canada Today

- Are Online Gambling Winnings Taxable In Canada Tax

Another important fact is that the winnings from online gambling activities are not taxable, as long as they are not considered as full-time employment. In other words, if you are playing online casino games for entertainment purposes, you won’t be required to pay any taxes upon your winnings. Once again, an intemperate gambler’s winnings are not taxable. Canada does not licence online casinos, other than those issued licenses from the Kahnawake Gaming Commission (KGC). Playing and winning at a KGC online casino, or any other licenced online casino, means your winnings are your own.

Every day, millions of people dream of winning a big Progressive Jackpot at a casino and pocketing a few million. In some countries, winnings from gambling count as taxable income, but the amount you pay can vary depending on whether you win at casino games, sports betting or the lottery. So, how do you keep more of your winnings when the taxman comes knocking?

Top Tax-Free Casinos

Although the benefits of playing for tax-free winnings are obvious, finding casinos that offer this perk is not always easy. Although taxes may not be imposed in all countries or circumstances, it always gives extra peace of mind to play at a casino that offers tax-free play. We have found some of the best casinos online that will absorb any applicable tax costs within the European Economic Area.

- Gambling in Canada. Whether one is betting on sports events, casino games or other forms of gambling, winnings are not taxed by the Canadian law. Winnings that are obtained from online gambling sites in Canada are never taxed. However, when it comes to poker, there is an exception.

- In Canada, online gamblers who make a living playing games of chance are perceived as professionals, which is why their winnings are seen as income and are, therefore, taxable. The tax rates will depend on the players’ location, as they differ in each of the provinces and territories.

One Casino

As a new player, at One Casino you can collect a No Deposit bonus of $/€10 and after using up your free bonus, deposit $/€10 and claim a 100% match on your deposit.

Locowin Casino

Head off to Locowin Casino, deposit from $/€10 and claim your Welcome Bonus up to $/€1850 in bonus cash and 500 free spins free from Wagering Requirements.

Jonny Jackpot Casino

At Jonny Jackpot Casino, deposit from $/€10 and you can double your first deposit up to a $/€1,000 and also get 100 free spins

Gambling Tax Laws by Country

Although many countries do not consider casino winnings to be taxable income, this is not true for all countries. In some locations, you could be taxed on sports bets or lottery winnings, but not on casino winnings. We take a look at gambling laws in Canada, Finland, Germany and the United Kingdom to show how these tax laws vary, and how choosing the right casino can reduce the tax burden on you.

Canada

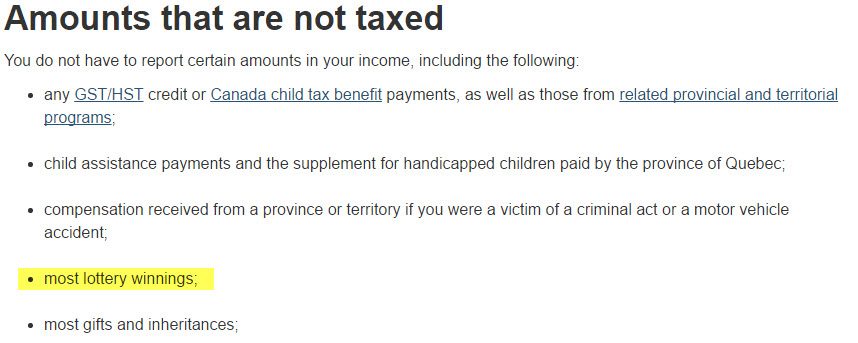

According to the Canadian Income Tax Act, casino winnings at both online and offline casinos are not taxable. The law goes back to British legislation which stated that wins from wagering should not be taxed, while wins from bookmakers taking the bet must be taxed. However, this applies only if your gaming is considered recreational play.

If you regularly make a profit off your gambling activities, you could be seen as a professional gambler. In this case, you may have to pay taxes as your winnings will be considered as income rather than the outcome of recreational luck. This only applies to certain forms of gambling though: lottery games, raffles, pull-tabs and Scratch’n Win games are not taxable. For land-based casinos, online casinos, sports betting, bingo, horse racing, poker, fantasy sports and eSports, recreational winnings are non-taxable, but professional winnings are taxed.

Finland

Most of the gambling industry in Finland is controlled by the state, and Finnish players do not have to pay tax if they play at any state-controlled casinos, including land-based and online casinos as well as lotteries, horse racing and sports betting.

Although foreign operators are not allowed to advertise in the country, Finnish players are not officially restricted from playing at online casinos that are operated by foreign companies. However, the tax implications vary depending on where these online casinos are registered.

If the casino operator is registered within the EEA, then Finnish players are exempt from paying tax on their winnings. If the casino operator is registered outside the EEA, then Finnish players will need to pay tax on their winnings. Although many online casinos hold licenses in either Malta or Curacao, some do not. If the casino holds a license from Kahnawake or Gibraltar, for example, then Finnish players will not be exempt from paying the gambling tax.

Germany

Germany has the highest gambling tax in the world, but the country has a “tax at source” system in place. This means that casinos are highly taxed on their gross gaming revenue but because the casino operators carry all the tax burden, the players do not have to pay tax on their casino winnings.

Sports betting falls under the Racing Bets and Lotteries Act, which means that it has different tax implications to both player and operator. Sports betting is taxed at a rate of 5% of the stake. Some sportsbooks absorb this cost, while others only charge the 5% on wins, but absorb it on player losses.

Regardless of the high tax bracket, there are still online casinos based in Germany and as players are exempt from paying taxes on their wins, they continue to enjoy casino games online. Players can win as much as luck allows them to and whether on slots, playing table games such as Roulette, Poker and Blackjack or sports bets, in Germany, what a player wins is what a player will take home.

United Kingdom

The United Kingdom is commonly accepted as being the most tightly regulated market in the world and legislation is far more bias towards the player’s interests than the casino’s needs. Gambling in the United Kingdom was legalized in 1968 with the introduction of the Gambling Act. By 2005, the act was amended to include regional and online casinos. Seasoned gamblers may recall the betting duties of a few years ago and the abolishment of those taxes in 2001 by Gordon Brown, who was Chancellor of the Exchequer at the time. The sudden rise of offshore betting forced the government to enact some changes like the Gambling Act of 2005, casino regulation and the establishment of the UK Gambling Commission.

Online casino taxation in the UK suffered a steep climb in Gross Gaming Revenue (GGR) taxation from 15% to 21% in October 2019. The GGR is calculated as the amount wagered by players less the winnings paid out by the bookmakers and casinos. This, along with tougher betting limit laws and credit card payment restrictions, made casino operators tighten their belts even more. Land-based operators are taxed up to 50% GGP, and because taxation is based on a tier system, some casinos can pay as little as 15% of their income, while gaming giants are subject to the maximum tariffs. While this is happening in the background, online casino enthusiasts are oblivious to the super taxes as they are exempt from paying taxes on casino wins. For both online and offline casinos for players that live in England, Scotland, Wales and Northern Ireland, all gambling winnings are tax-free.

Around The World

Gambling tax regulations vary hugely from place to place and while in some countries land-based and online casinos are subject to a tax deduction on their winnings and profits, in other instances the player is obliged to declare their wins as taxable income. Although most countries do not tax gambling winnings, there are exceptions. Winners in France are obliged to pay 12% tax on any win over $/€1,500 while in Spain, gambling is taxed as personal income.

In Kenya, until 2017, casino operators and sports betting companies were taxed at 7.5% on gross gaming revenue. In 2017, in an attempt to help young people pursue career choices instead of spending their time gambling, Kenya increased their tax percentage rate to 35%. For their 2019/2020 budget, Kenyan tax on sports betting was increased to 20%.

Conclusion

The continual rise of online casinos leaves little doubt the online gambling offers massive entertainment and excitement. If you play at one of our reviewed and recommended tax-free online casinos, you will not be chased by the tax authorities, nor will you be asked to declare your winnings. So enjoy playing online casino games, chase those big Progressive Jackpot prizes and if you’re lucky enough to win, the prize is all yours to enjoy.

Frequently Asked Questions

❓ What exactly is Gambling Taxation?

🙋♀️ Do all countries allow tax-free winnings at online casinos?

🎲 Are There Different Rules for land-based casinos?

💰 Do I need to keep proof of my wins at online casinos?

📋 What are the Pros and Cons of Tax-Free Winnings?

Pros

- Online casino players don’t have to pay taxes on their casino and sports betting wins

- The casino operator pays all the taxes. Much of it is used to pay for society’s costs.

- Online casino players can take home all their wins, even million-euro jackpot prizes.

Cons

Are Online Gambling Winnings Taxable In Canada Today

- The taxes are not high enough to eliminate gambling addiction.

- Taxes don’t pay all of society’s costs.